Compute present value

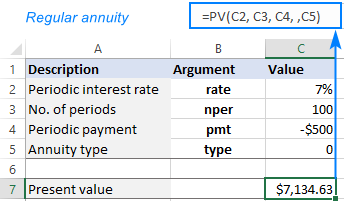

PV can be calculated in excel with the formula PV rate nper pmt fv type. The premise of the NPV formula is to compare.

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-eea50904f90744e4b1172a9ef38df13f.jpg)

Net Present Value Npv What It Means And Steps To Calculate It

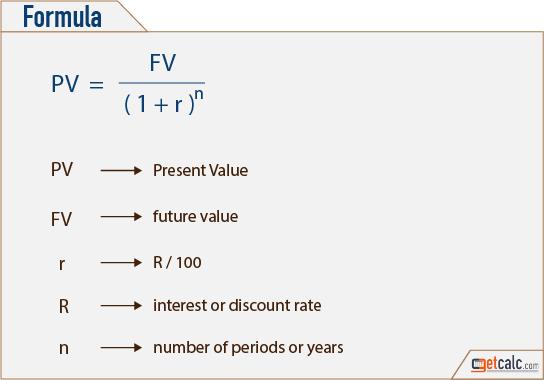

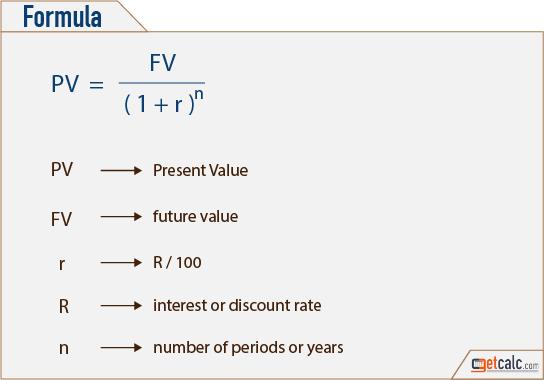

The present value formula PV formula is derived from the compound interest formula.

. Present value is the value of money right now today. Substituting cash flow for time period n CFn for FV interest rate for the same period i n we calculate present value for the cash flow for that one period PVn P V n C F n 1 i n n. Hence the formula to calculate the present value is.

Given a projected or desired future value of money an interest rate and a number of interest periods the present value calculator can compute the present value of that money or the. The Present Value Formula. Present Value Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at.

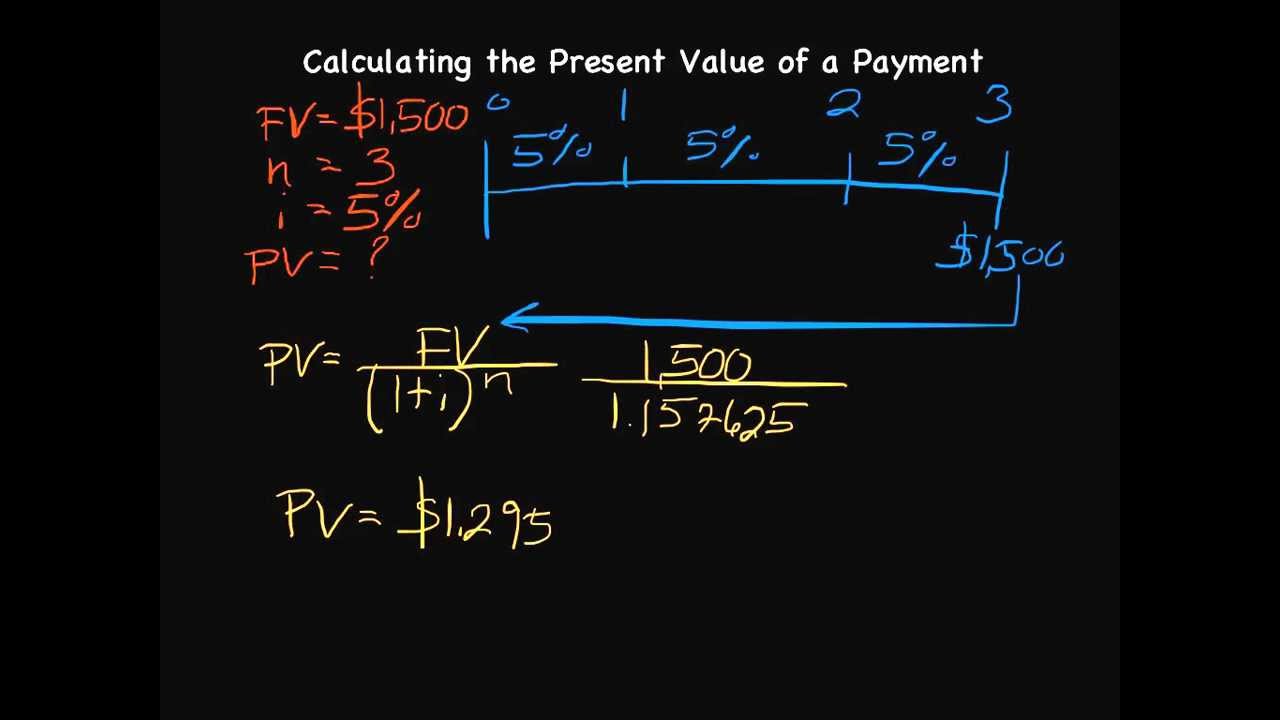

Present value 200011 2000112 4000113 5000114. The present value PV is equal to the discounted value of the series of cash flows at the discount rate r. The two functions use the same math formula as shown above but they save an analyst time by not.

The present value formula for annual or any period really interest. If FV is omitted PMT must be included or. Ultimately the Present Value or is the value of something today in the present.

The answer tells us that receiving 1000 in 20 years is the equivalent of receiving 14864 today if the time value of money is 10 per year compounded annually. Net present value is a capital budgeting analysis technique used to determine whether a long-term project will be profitable. So its the value of future expectations or future cash flow expressed in todays terms.

Present value PV is the current value of a stream of cash flows. Find Out How to Calculate Present Value of an Investment in the UK. PV FV 1 r nnt Where PV Present value.

Ad Learn How to Calculate Present Value of an Investment with Our Affordable Lessons. The general solution comes in this formula. 100 today has a present value of 100 but 100 one year from now is worth slightly less because money loses value over time as prices.

Calculation Using a PV of 1. PVfrac C 1in P V 1 inC. In practice there are three steps to compute the present value of a bond.

Annuity Present Value Pv Formula And Calculator Excel Template

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg)

Formula For Calculating Net Present Value Npv In Excel

Formula For Calculating Net Present Value Npv In Excel

Calculating Present Value Accountingcoach

Present Value Of An Annuity How To Calculate Examples

How To Calculate Present Value Youtube

Present Value Calculator

Present Value Of An Annuity How To Calculate Examples

Present Value Of A Single Cash Flow Finance Train

Using Pv Function In Excel To Calculate Present Value

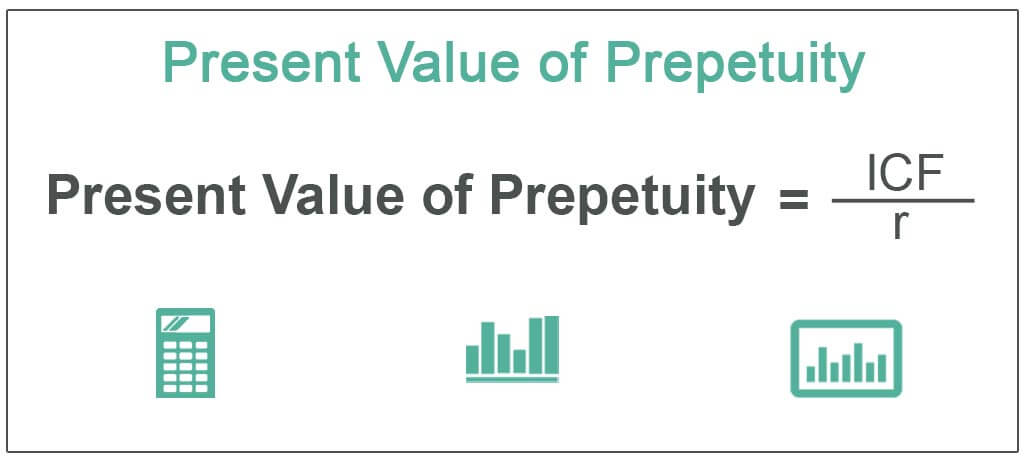

Present Value Of Perpetuity How To Calculate It Examples

Present Value Formula With Calculator

Pv Of Perpetuity Formula With Calculator

Present Value Formula With Calculator

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

Present Value Formula Calculator Examples With Excel Template

Present Value Pv Calculator